In the wake of the pandemic, energy costs and energy security have become two hot button topics that have really driven interest in home batteries and more complex energy storage systems (ESS) over the past couple of years, and a recent study seems to confirm that consumer sentiment over energy price and the grid remains rather low.

The third-party research was conducted on behalf of LG Electronics USA by the company Mower. This random survey of 1,579 U.S. homeowners was completed in January 2024. It has a margin of error of plus or minus 2.5 percent.

Over the past year, the study found that two out of every three respondents experienced a power outage while half of all respondents stated they experience multiple outages annually.

Of those experiencing an outage, 50% said the outage lasted more than 30 minutes. Another 14% said they had outages lasting at least three hours.

When it came to issues associated with power loss, homeowners expressed their major concerns as being no internet for communication (43%), an inability to charge communication devices (40%), and inability to heat/cool homes (46%).

This, understandably, expressed itself in homeowners being rather frustrated over grid instability and concerns over the impact of extreme whether events. Of course, part of that frustration also lies in the cost of the service compared to the quality.

While inflation has calmed down since the pandemic, deflation has not and is not likely to kick in the same way inflation did at the start, meaning a spottier, less reliable service is now costing the average homeowner far too much for what they’re getting, in their opinion.

According to the survey, 67% of homeowners class their home energy bill costs as being “too high” with 21% saying that their bills have gotten “much higher” over the past year.

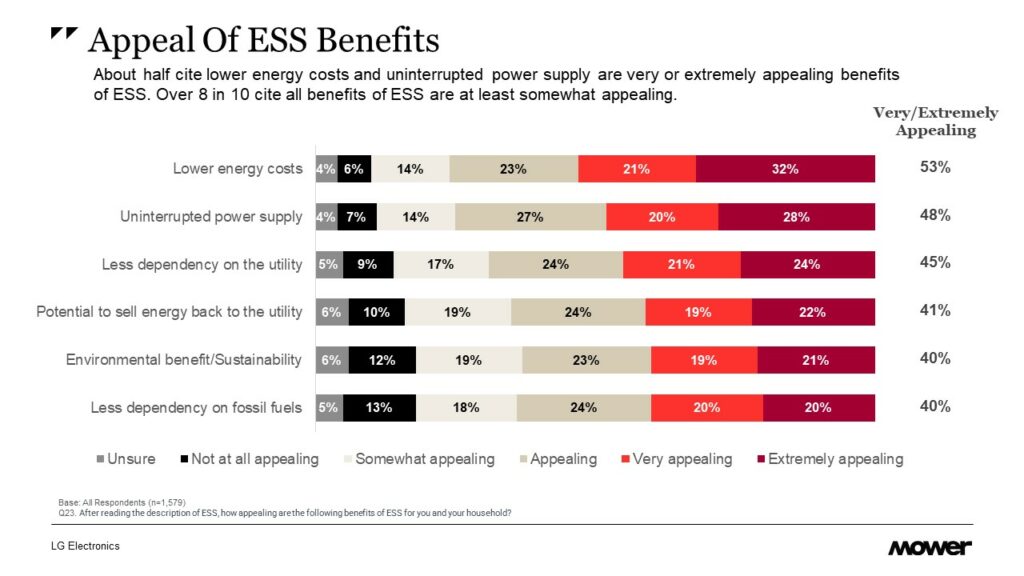

It should come as no surprise then that when homeowners turn to solutions like a home battery or ESS, they are most interested in slashing energy costs (90%) though the appeal of an uninterrupted power supply (89%) a close second.

Ranked lower but still not too far off in terms of interest is being able to sell back to the utility (84%), environmental sustainability (82%) and reducing dependency on infrastructure related to fossil fuels (82%).

Among homeowners who already own residential solar, one quarter report already owning an ESS while eight in 10 of those who do not own one say it is a future priority. Meanwhile, 12% say it is a “number one priority.”

What this potentially translates to for dealers and other individuals in the field of professional technology installations, however, is the capacity to entice homeowners with these solutions with a little bit of education, as it is worth noting that these survey results reveal consumer interest in home batteries and ESS post-education on the topic.

In CE Pro’s own discussions with integrators, it seems that while luxury clients aren’t as concerned with energy spending as middle market consumers, energy security is a universal topic that can draw in homeowners on just about every budget, with many of the top projects featuring home batteries or ESS systems having them in place primarily for grid resiliency and operational consistency.

For more detailed results of the survey itself, readers are instructed to contact Owen Serey at Mower.